Panic focusing on the failure of the investment banking industry culminated in a loss of more than 10% on September 29, 2008, subsequently plunging the index firmly into a bear market. Īfter a gradual 5-year recovery to an intraday high of 2,239.51 on October 31, 2007, the highest reached since February 16, 2002, the index corrected below the 2,000 level in early 2008 amid the Late-2000s recession, the United States housing bubble and the Financial crisis of 2007–2008. The index set highs above the 4,700 level at the peak of the dot-com bubble in 2000, but fell 78% during the Stock market downturn of 2002. Both are among the most heavily traded futures at the exchange.

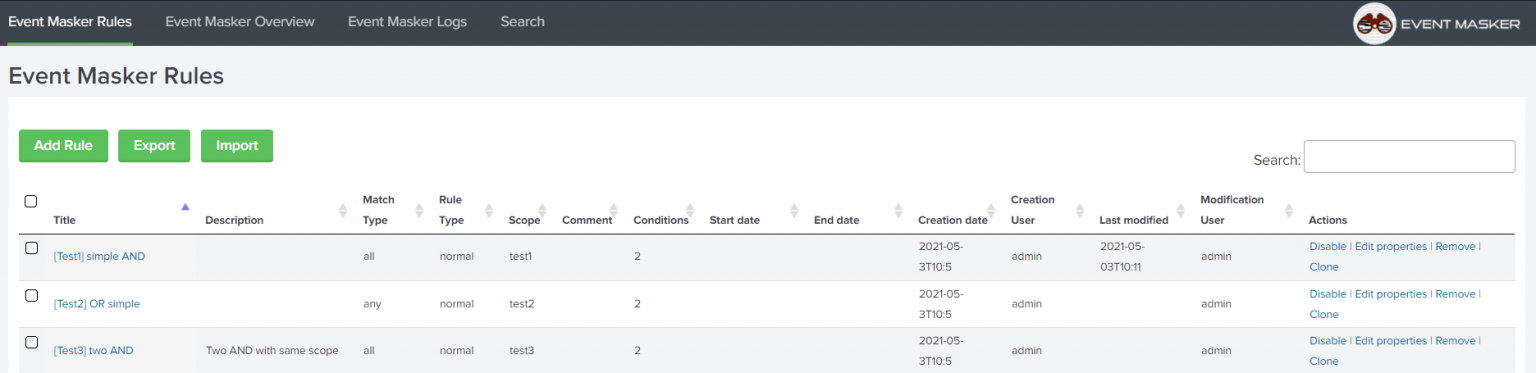

SPLUNK SIGMA RULES CODE

The regular futures are denoted by the Reuters Instrument Code ND, and the smaller E-mini version uses the code NQ. Its corresponding futures contracts are traded on the Chicago Mercantile Exchange. The Nasdaq-100 is often abbreviated as NDX, NDQ, NAS100 or US100 in the derivatives markets. QQQ is one of the most actively traded exchange-traded funds in the United States. Retail buy and hold investors might prefer to purchase Invesco's similar Nasdaq: QQQM, or "QQQ Mini" which has a lower fee structure, but lacks the liquidity that high-frequency traders need in the traditional QQQ product. On March 23, 2011, Nasdaq changed its symbol back to QQQ. On December 1, 2004, it was moved from the American Stock Exchange, where it had the symbol QQQ, to the Nasdaq, and given the new ticker symbol QQQQ, sometimes called the "quad Qs" by traders.

SPLUNK SIGMA RULES SERIES

It was formerly called Nasdaq-100 Trust Series 1. The Invesco QQQ exchange-traded fund, sponsored and overseen since Maby Invesco, trades under the ticker Nasdaq: QQQ. Those standards were relaxed in 2002, while standards for domestic firms were raised, ensuring that all companies met the same standards. Foreign companies were first admitted to the Nasdaq-100 in January 1998, but had higher standards to meet before they could be added. The first annual adjustments were made in 1993 in advance of options on the index that would trade at the Chicago Board Options Exchange in 1994. The base price of the index was initially set at 250, but when it closed near 800 on December 31, 1993, the base was reset at 125 the following trading day, leaving the halved Nasdaq-100 price below that of the more commonly known Nasdaq Composite. It created two indices: the Nasdaq-100, which consists of Industrial, Technology, Retail, Telecommunication, Biotechnology, Health Care, Transportation, Media and Service companies, and the Nasdaq Financial-100, which consists of banking companies, insurance firms, brokerage firms, and Mortgage loan companies. The Nasdaq-100 was launched on Januby the Nasdaq. The financial companies are in a separate index, the Nasdaq Financial-100.

It is limited to companies from a single exchange, and it does not have any financial companies. The stocks' weights in the index are based on their market capitalizations, with certain rules capping the influence of the largest components. It is a modified capitalization-weighted index. The Nasdaq-100 ( ^NDX ) is a stock market index made up of 101 equity securities issued by 100 of the largest non-financial companies listed on the Nasdaq stock exchange.

0 kommentar(er)

0 kommentar(er)